The High Price Strategy of Luxury Fashion

The big three name of luxury fashion, such as Chanel, Hermès and Dior, determine the direction of the industry with their high price strategy.

Unfortunately, we are now talking about price increases not on a national scale but on a global scale. We talked about the price hikes that Chanel will make in 2022 as a result of its new market strategy. The brand, which set Hermès as its target, made some updates to control the second-hand market, as well as new and high price tags, and took the step of creating a more exclusive image by limiting sales quantities and reducing accessibility.

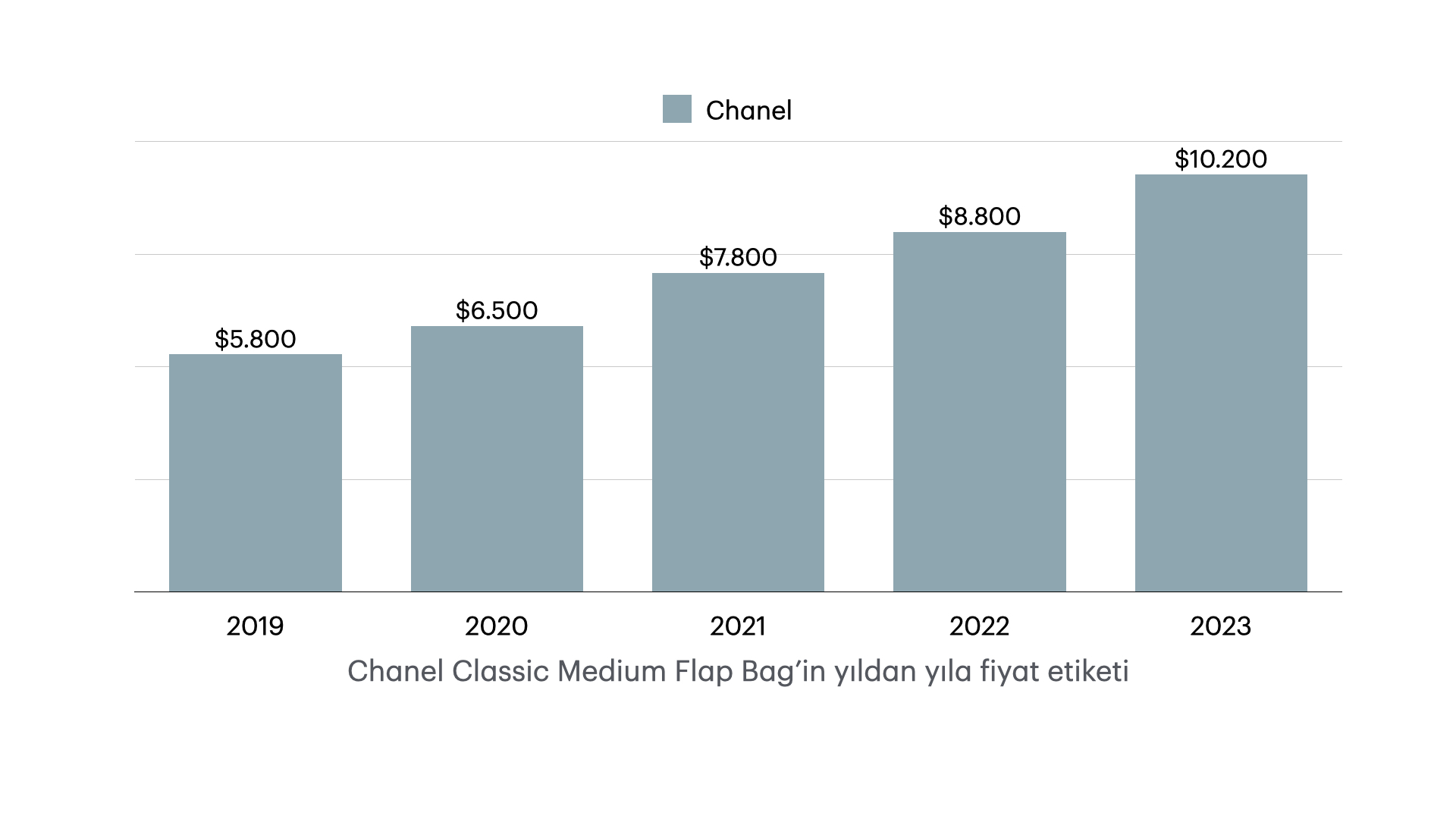

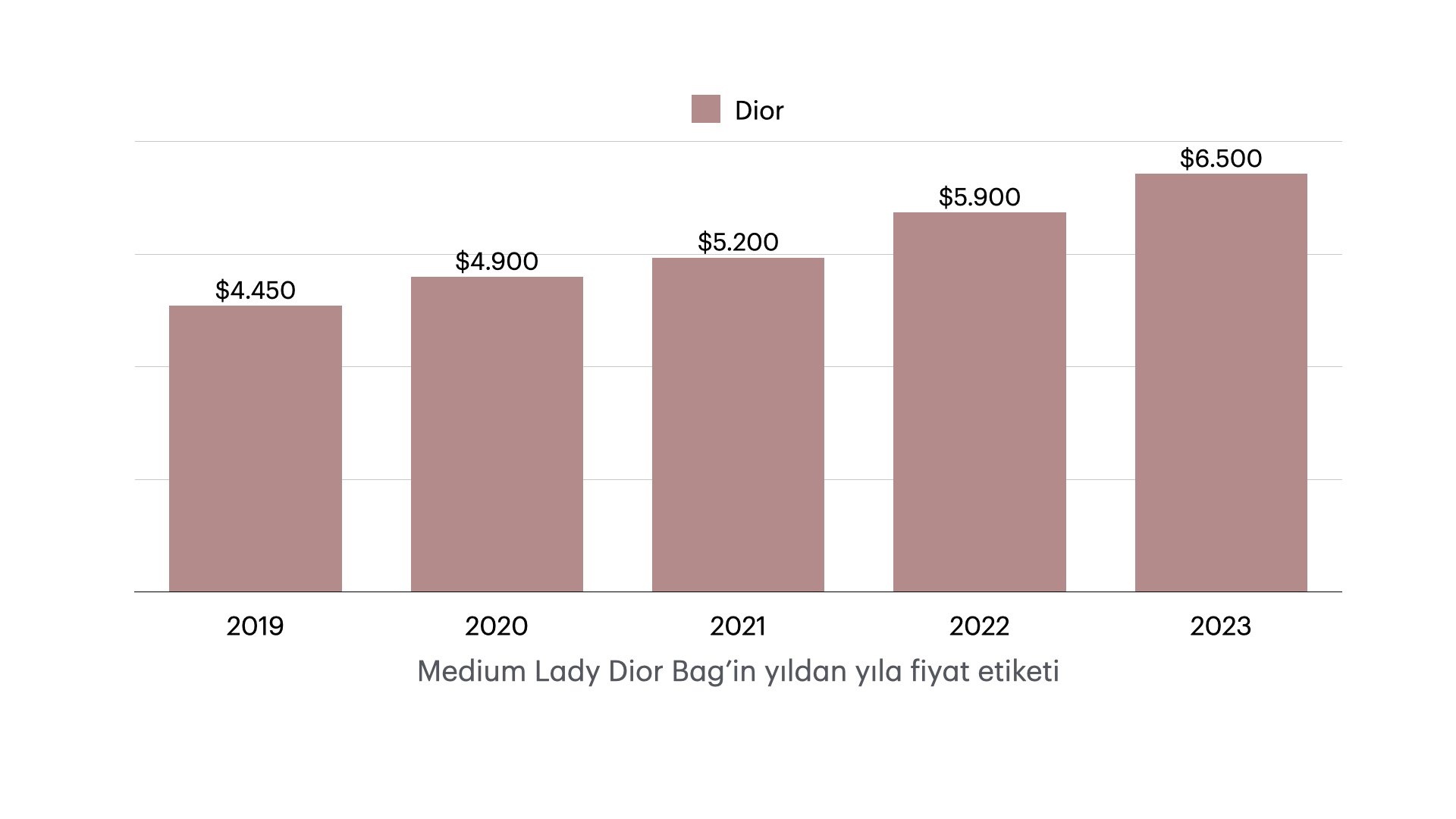

Two years have passed, strategies have evolved, and price tags have been renewed again and again. Moreover, of course, this innovation was not limited to Chanel. We can say that the big three of investment bags, Hermès, Dior and Chanel, have proven that they have high-return pieces. If we put the price increases from year-to-year side by side, we can have a better understanding of the cliff-like difference.

Chanel is one of the most aggressive about labels. There is almost a 75 percent difference between the prices of the Medium Flap Bag in 2019 and 2023. We finished the chart in 2023, but Chanel’s price list was recently updated. Chanel, which made its first price increase in the Far Eastern market in September, has just made its promise for America and Europe: The new price of the Medium Flap Bag is exactly 10,800 dollars. In other words, another 6 percent difference was added to the previous year.

Let’s talk about another name, Dior. We examine Dior’s price adventure through the Medium Lady Dior Bag. The 2019-2023 price difference is approximately 46 percent. Although not as much as Chanel, Dior has not lagged an aggressive strategy. Meanwhile, let us remind you that Dior made two price increases in 2023.

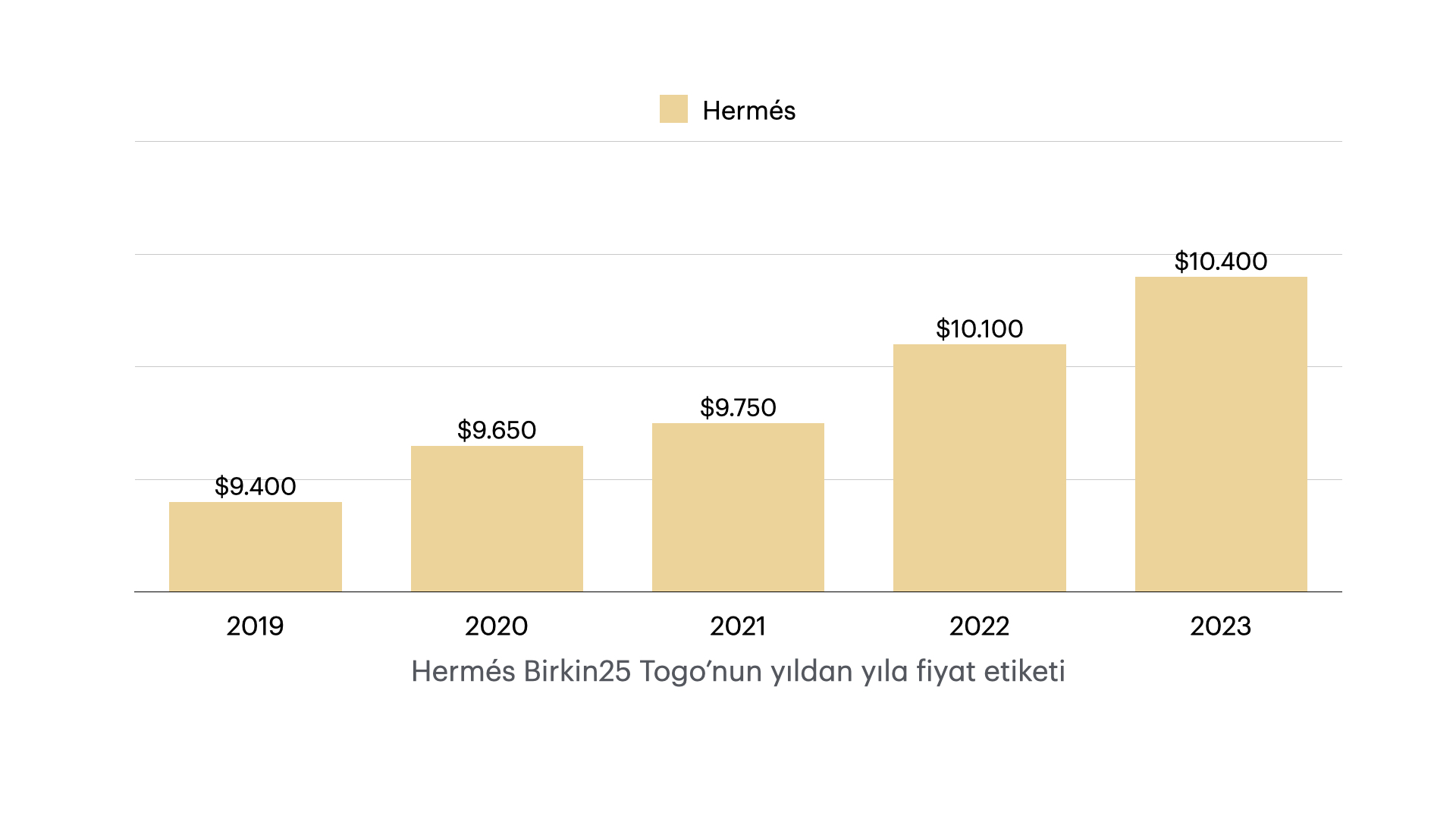

Yes, now it’s Hermès. Hermès’ price increase is a little more understandable. The brand, where its competitors have made dramatic changes to reach it, is increasing relatively in direct proportion to inflation until 2023. There is a 10 percent price difference between 2019 and 2013. However, there is a $1000 jump in the recently announced 2024 raises. The price of Birkin25 Togo this year is $11,400.

We give price increases on selected models, but other parts of the collections also receive their share of this policy. For example, at Hermès, there are increases ranging from 5 percent to 40 percent.

Let’s leave the labels aside and examine the reasons for this price strategy. This strategy has different aspects. The first items are the first and most predictable reasons that come to mind. As you know, inflation is a problem not only in our country, but also in Europe and America, although not as much as in our country. When you add increasing raw material, labor, production and merchandising costs, price increases are inevitable for brands to meet quality standards and serve their customers with the same care.

If we leave aside the visible financial reasons of the situation and examine it from the perspective of customer experience and brand value… When luxury fashion and high fashion are mentioned, many brands come to mind. However, among these brands, there are some names called crème de la crème, like the ones we mentioned above. In addition to the price increases to widen the gap with the rest of the list and to underline that they are more featured and privileged, there is also the aim of appealing to a more specific and limited audience. The concept of “abundant rarity” forms the basis of growing luxury. The more a brand is found and accessible, the more it is faced with losing its exclusiveness and therefore its crème de la crème status. This price gap allows brands to play hard.

According to a study by McKinsey, potential luxury customers make up 18 percent of the fashion market, worth 273 billion euros. This group also has a major share in the development of luxury fashion after the pandemic. However, our crème de la crème goes awry. Because their target is not this audience, which is seen as the new potential of luxury, but a more refined list. Maybe it’s a bit harsh, but the goal is to appeal to ‘the truly wealthy’ rather than “those who want to look rich”. Not affected by economic fluctuations; does not care about dramatic price increases; Appealing to a group sensitive to quality, craftsmanship and exclusivity is at the center of true luxury.

The contradictory part begins at this stage. Having such a limited customer base, how can you make your partners happy and fill the brand’s coffers? According to experts, profitability and rarity are two concepts that do not get along well with each other. It is necessary to find that fine line between accessibility and exclusivity and to be able to walk on that line in a balanced way. While aggressive strategies keep brands at the focal point of the industry and keep the excitement for them alive, the loyalty bond between VIP customers and brands ensures sustainability in price strategies and profitability. Judging by Chanel’s announced data, the balance works and everything seems to be fine. The French fashion giant, whose profit in 2020 was 2 billion dollars, made a profit of 5.5 billion dollars in 2021 and 5.8 billion dollars in 2022.

The parameters of luxury fashion are quite different from classic retail. The continuity of price strategies and the winners of strategy wars in the sector, where not only material goods but also emotions and values are discussed, are a matter of curiosity. We are following with excitement.